The tech world is brimming with excitement as the much-anticipated IPO of Astera Labs approaches. While many might have their eyes fixed on more talked-about companies like Reddit, Astera Labs represents a different kind of opportunity—one that could provide insights into how investors view AI-centric tech within the current market landscape. With an impressive adjustment to its initial offering plans, Astera is primed for potential marketplace disruption.

The IPO Landscape and Astera’s Unique Position

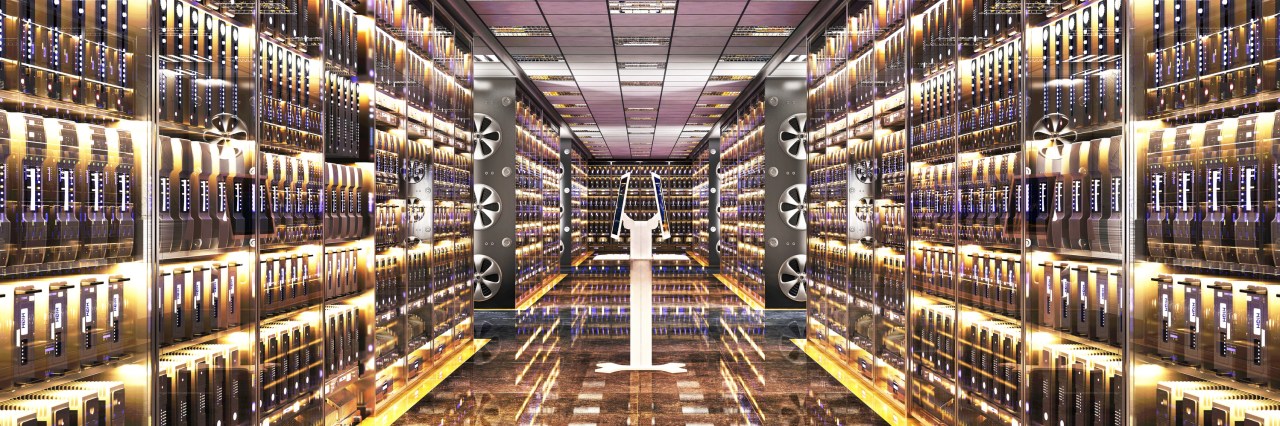

Astera Labs, noted for its connectivity hardware tailored for cloud computing data centers, is stepping into the public arena with an initial offering of 19.8 million shares, priced at $32 to $34 each. When it went public, that price was set even higher at $36, underscoring not just confidence in the company, but a resurgent interest in tech IPOs in general.

- Growth Trajectory: Astera’s revenue has seen a remarkable spike from $79.9 million in 2022 to $115.8 million in 2023, reflecting a 45% increase. This surge is largely fueled by the burgeoning demands of AI, which necessitates robust data center capabilities for processing massive volumes of information.

- Profitability Puzzle: Despite a substantial operating loss until late 2023, Astera’s financials began showing signs of reversing course, culminating in an unexpected profit of $14.3 million in Q4 2023.

Diving Deeper: The AI Connection

Astera Labs is keen to position itself within the AI boom narrative, evidenced by the frequency of the term “AI” appearing in its SEC filings. However, some skeptics argue that Astera is riding the coattails of AI demand rather than directly being an AI company itself. Nick Einhorn, from Renaissance Capital, points out that while the company benefits from the upward trend of data center spending driven by AI, its direct alignment to the AI narrative remains ambiguous.

This is further illustrated by Amazon’s investment interest, as it signed a warrant agreement for 1.5 million shares, hinting at a possible collaboration, though not definitive proof of a formal customer relationship.

The Challenge of Customer Concentration

Astera faces the reality of significant customer concentration, with three primary clients accounting for approximately 70% of its revenue in 2023. This reliance might raise red flags for investors concerned about the potential volatility in future earnings. Einhorn warns of the unpredictable nature of customer buying patterns, emphasizing that just because the recent quarters exhibited success does not guarantee continuity.

The Bigger Picture: What This Means for the Tech IPO Market

The impending Astera Labs IPO is not merely a singular event but could potentially setting the stage for a wave of tech IPOs. As other companies within the AI and technology sphere look at this indication of investor appetite, they may find renewed motivation to pursue public offerings of their own. Should Astera gather strong momentum post-IPO, it could pave the way for new startups benefiting from AI to draw investor interest in a marketplace hungry for innovation.

Conclusion: A Test of Market Sentiment

The story of Astera Labs encapsulates the dynamic intersection of technology and investor sentiment in a post-pandemic world eager for growth and innovation. Their IPO may serve as a litmus test for how market players perceive the AI revolution’s implications on hardware and overall tech investment. The next few months could reveal whether Astera’s success will ignite further offerings or whether it remains an outlier in a challenging market landscape.

At fxis.ai, we believe that such advancements are crucial for the future of AI, as they enable more comprehensive and effective solutions. Our team is continually exploring new methodologies to push the envelope in artificial intelligence, ensuring that our clients benefit from the latest technological innovations.

For more insights, updates, or to collaborate on AI development projects, stay connected with fxis.ai.