What is an Automated Market Maker (AMM)?

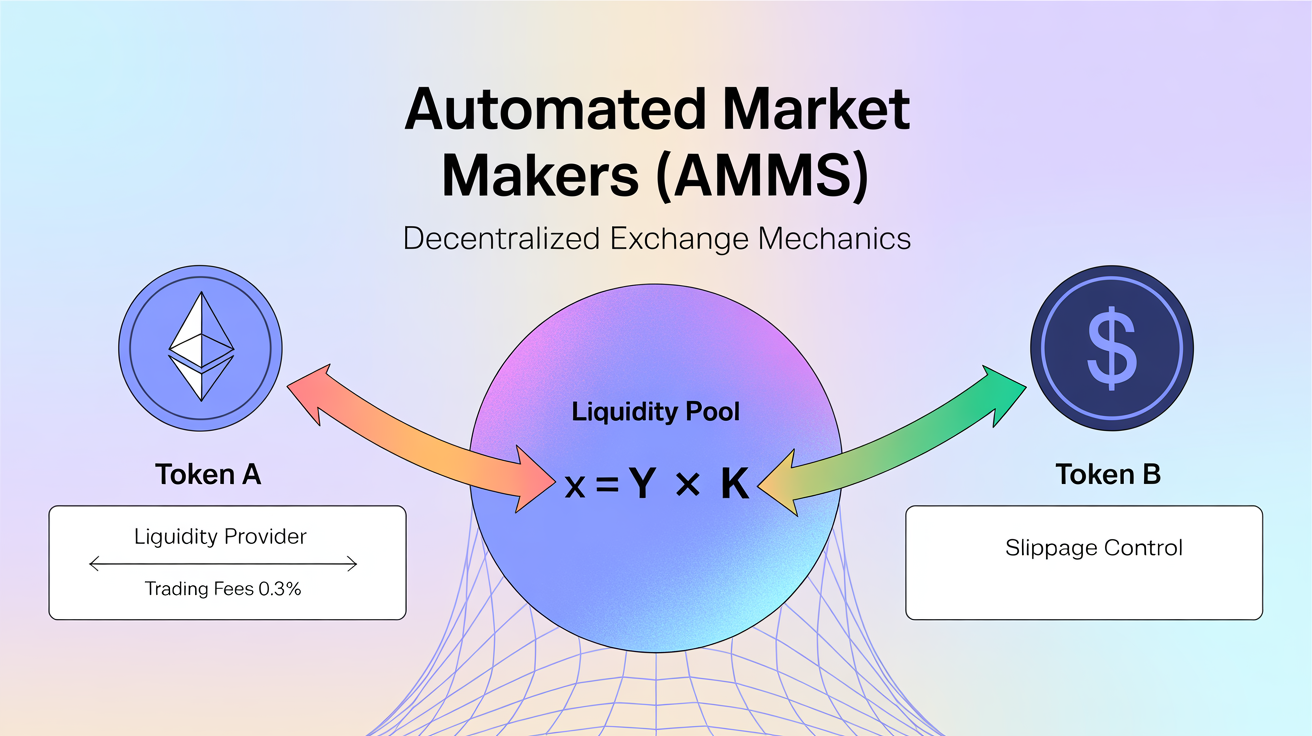

An automated market maker is a type of decentralized exchange protocol that relies on mathematical formulas to price assets instead of using traditional order books. Unlike conventional exchanges where buyers and sellers create orders, AMMs use liquidity pools where users trade directly against pooled funds.

The fundamental innovation behind automated market maker protocol design is removing the need for counterparties in trades. When you want to buy a token, you don’t wait for someone else to sell it to you. Instead, you trade with a smart contract that automatically adjusts prices based on supply and demand.

These protocols operate entirely on blockchain networks through smart contracts. Therefore, they function 24/7 without any central authority controlling operations. Anyone can access them, and transparency is built into every transaction since all activities are recorded on the blockchain.

The concept emerged as a solution to liquidity problems in decentralized trading. Traditional order book exchanges struggle when there aren’t enough buyers or sellers. Conversely, AMMs solve this by incentivizing users to deposit funds into liquidity pools, ensuring trades can always execute.

Understanding Automated Market Makers: Core Principles and Mechanisms

To truly grasp automated market maker protocol design, you need to understand how these systems create markets without human market makers. The process involves several interconnected components working together seamlessly.

Liquidity pools form the foundation of every AMM. These pools are smart contracts containing reserves of two or more tokens. Users deposit equal values of these tokens into pools, becoming liquidity providers. In return, they receive pool tokens representing their share of the total liquidity.

When someone trades using an AMM, they interact directly with these liquidity pools. The protocol uses predetermined mathematical formulas to calculate how many tokens the trader receives. Consequently, prices adjust automatically with each transaction based on the formula’s rules.

Liquidity providers earn fees from every trade that occurs in their pool. Typically, these fees range from 0.01% to 1% per transaction, depending on the protocol and pool settings. Additionally, the fees accumulate over time, creating passive income opportunities for providers.

The automated market maker protocol design eliminates several pain points from traditional trading:

- No need to find matching buy and sell orders

- Instant trade execution regardless of order size

- Transparent pricing algorithms visible to everyone

- Permission-less access without geographic restrictions

However, this system also introduces unique characteristics. Prices are determined algorithmically rather than by direct market forces. Furthermore, large trades can significantly impact prices within pools, creating slippage that differs from traditional exchange experiences.

Smart contracts handle all operations automatically. These self-executing programs ensure trades occur exactly as programmed, without human intervention or the possibility of manipulation by centralized parties.

How Do AMMs Work? The Constant Product Formula and Trading Mechanics

The magic behind automated market maker protocol design centers on mathematical formulas that maintain balance within liquidity pools. The most common formula is the constant product model: x*y=k.

In this equation, ‘x’ represents the quantity of one token in the pool, while ‘y’ represents the quantity of the other token. The product of these two amounts equals ‘k’, which remains constant regardless of how many trades occur. Therefore, when someone trades one token for another, the ratio between tokens changes, but their product stays the same.

Let’s explore a practical example to see this in action. Imagine a liquidity pool contains 100 ETH and 200,000 USDC. The constant k would equal 20,000,000 (100 × 200,000). If a trader wants to buy 10 ETH from the pool, they must add enough USDC to maintain this constant product.

After the trade, the pool would contain 90 ETH. Using the constant product formula, we can calculate that the pool needs approximately 222,222 USDC to keep k constant at 20,000,000. Consequently, the trader must deposit about 22,222 USDC to receive 10 ETH.

This mechanism automatically adjusts prices based on supply and demand dynamics:

- When traders buy a token, its price increases within the pool

- When traders sell a token, its price decreases within the pool

- Larger trades cause more significant price movements

- Arbitrageurs help align pool prices with external market prices

The pricing mechanism works continuously without breaks. As tokens are bought from the pool, they become scarcer, making them more expensive. Conversely, as tokens are sold to the pool, they become more abundant, reducing their price.

Arbitrage traders play a crucial role in maintaining price accuracy. When AMM prices diverge from broader market rates, arbitrageurs profit by buying from the cheaper source and selling to the more expensive one. This activity naturally pushes AMM prices back toward market equilibrium.

Different AMM protocols use variations of pricing formulas optimized for specific use cases. Some use constant sum formulas, while others employ hybrid models. Nevertheless, the constant product formula remains the most widely adopted approach in automated market maker protocol design.

Potential Benefits of Using AMMs

Automated market maker protocol design offers numerous advantages that have made decentralized trading increasingly popular. These benefits appeal to both traders and liquidity providers, creating a thriving ecosystem of participants.

For traders, AMMs provide several compelling advantages. First, they offer permission-less access—anyone with a cryptocurrency wallet can trade without creating accounts or completing identity verification. Additionally, AMMs operate 24/7 without downtime, unlike traditional exchanges that may close during maintenance or emergencies.

Transparency represents another significant benefit. All trades, liquidity additions, and removals are recorded on the blockchain where anyone can verify them. Furthermore, pricing algorithms are open-source, allowing users to understand exactly how prices are calculated before trading.

AMMs democratize market making opportunities. Previously, only sophisticated firms with significant capital could become market makers. Now, everyday users can provide liquidity and earn trading fees. Moreover, the barriers to entry are minimal—you can start with amounts as small as a few dollars.

Liquidity providers gain multiple income streams through automated market maker protocol design:

- Trading fees from every transaction in their pool

- Potential token rewards from liquidity mining programs

- Price appreciation if their deposited tokens increase in value

- Flexibility to withdraw liquidity whenever needed

The technology also reduces counterparty risk since trades execute through smart contracts rather than relying on centralized intermediaries. Users maintain custody of their assets until the moment of trading. Consequently, the risk of exchange hacks or insolvency affecting your funds decreases significantly.

Capital efficiency has improved dramatically with recent innovations. Advanced protocols now allow liquidity providers to concentrate their capital in specific price ranges where trading actually occurs. This means your funds work harder, earning more fees per dollar invested.

AMMs also enable the creation of markets for new or less popular tokens. Traditional exchanges often reject tokens with insufficient trading volume. However, anyone can create a liquidity pool for any token pair, fostering innovation and giving emerging projects access to trading venues.

The composability of decentralized finance means AMM liquidity can serve multiple purposes simultaneously. Your liquidity pool tokens might be used as collateral for loans, staked in other protocols, or incorporated into complex financial strategies—all while still earning trading fees.

Important Considerations: Risks and Challenges

While automated market maker protocol design offers significant benefits, you must understand the risks before participating. These systems introduce unique challenges that differ from traditional trading environments.

Impermanent loss represents the most significant risk for liquidity providers. This phenomenon occurs when token prices change after you’ve deposited assets. The AMM automatically rebalances your position to maintain the constant product formula, potentially leaving you with less value than if you had simply held the tokens.

Consider this scenario: you deposit tokens when they have equal value, but one token doubles in price while the other stays flat. The AMM sells some of your appreciating token to buy more of the stable token. As a result, you capture less of the upside compared to holding the original assets.

Several factors influence impermanent loss severity:

- The magnitude of price divergence between paired tokens

- Volatility of the assets in the pool

- Time period over which price changes occur

- Whether trading fees offset the losses

Slippage poses another challenge in automated market maker protocol design. Large trades move prices significantly within pools, meaning you might pay more than expected when buying or receive less when selling. The constant product formula causes this effect—as you remove tokens from the pool, their price increases during your transaction.

Smart contract risks exist across all decentralized finance protocols. Bugs in code, unforeseen interactions between protocols, or successful attacks can lead to loss of funds. Although major protocols undergo extensive auditing, vulnerabilities occasionally emerge. Therefore, never invest more than you can afford to lose.

Front-running and MEV (Maximal Extractable Value) can negatively impact your trades. Sophisticated traders use bots to detect pending transactions and insert their own trades before yours executes. This practice can worsen your execution price, though various protection mechanisms are being developed.

Low liquidity pools amplify many risks. Slippage becomes extreme, price manipulation becomes easier, and impermanent loss can intensify. Consequently, you should carefully evaluate pool depth and trading volume before providing liquidity or executing large trades.

Token-specific risks also apply. Projects may have vulnerabilities, development teams might abandon them, or regulatory issues could arise. Diversification across multiple pools and tokens helps manage these risks somewhat.

Advanced Concepts: Concentrated Liquidity and Capital Efficiency

Recent innovations in automated market maker protocol design have addressed fundamental limitations of traditional models. The most significant advancement involves concentrated liquidity, which dramatically improves capital efficiency.

Traditional AMMs spread liquidity across the entire possible price range from zero to infinity. This approach means most capital sits idle, never being used for trades. For example, a pool might have liquidity at extreme prices like $100 or $50,000 where trades rarely occur.

Concentrated liquidity allows providers to choose specific price ranges where they deploy their capital. If you believe an asset will trade between certain boundaries, you can focus your liquidity there. Consequently, your capital becomes active during more trades, earning substantially higher fees.

This innovation delivers several powerful advantages. Capital efficiency improves dramatically—sometimes by thousands of times compared to full-range liquidity. Traders benefit from lower slippage because liquidity concentrates where trades actually happen. Additionally, providers can implement sophisticated strategies matching their market outlook.

However, concentrated liquidity introduces new complexities:

- Positions go “out of range” when prices move beyond selected boundaries

- Active management becomes necessary to maintain optimal earnings

- More frequent adjustments may be required as market conditions change

- The learning curve steepens for newcomers to automated market maker protocol design

Stablecoin pairs benefit tremendously from concentrated liquidity. Since similar stablecoins typically trade within very tight ranges, providers can concentrate massive liquidity there while earning substantially more fees than spreading capital unnecessarily.

The evolution continues with dynamic fee structures, oracle integrations, and hybrid models combining multiple pricing mechanisms. Understanding these advanced concepts positions you to take advantage of the most efficient opportunities in decentralized trading.

FAQs:

- What is the main difference between AMMs and traditional exchanges?

Traditional exchanges use order books where buyers and sellers submit orders that get matched. AMMs instead use liquidity pools and mathematical formulas to determine prices automatically, eliminating the need for order matching and enabling instant trades without waiting for counterparties. - Can I lose money providing liquidity to an AMM?

Yes, primarily through impermanent loss when token prices diverge from your deposit ratio. Additionally, if trading fees don’t compensate for impermanent loss, you might end up with less value than simply holding the tokens. Smart contract risks and potential exploits also exist, so careful evaluation is essential. - How do AMMs determine token prices?

AMMs calculate prices based on the ratio of tokens in liquidity pools using formulas like x*y=k. As traders buy one token, it becomes scarcer in the pool, automatically increasing its price. Arbitrage traders help keep AMM prices aligned with broader market rates by profiting from price differences. - What makes concentrated liquidity more efficient?

Concentrated liquidity allows providers to focus their capital within specific price ranges where trading actually occurs, making capital significantly more efficient. This results in higher fee earnings for providers and lower slippage for traders in active price ranges, though it requires more active position management. - How much can I expect to earn as a liquidity provider?

Earnings vary widely based on trading volume, pool fees, asset volatility, and impermanent loss. Stablecoin pools might offer lower but steadier returns with minimal risk, while volatile pairs could earn higher fees but face substantial impermanent loss. Always calculate potential risks before providing liquidity to any pool

Stay updated with our latest articles on fxis.ai