Picture this: you’re driving on a highway when suddenly the road splits into two paths. Similarly, blockchain networks occasionally reach crossroads where they must choose between different protocol directions. These decision points, known as blockchain forks, represent pivotal moments that can either upgrade existing networks or create entirely new blockchain ecosystems.

Unlike traditional software updates controlled by centralized entities, blockchain forks require coordination across thousands of independent nodes worldwide. This decentralized approach to network evolution creates unique challenges and opportunities. Furthermore, these mechanisms have shaped the cryptocurrency landscape we know today, spawning new coins and enabling unprecedented innovation in decentralized finance.

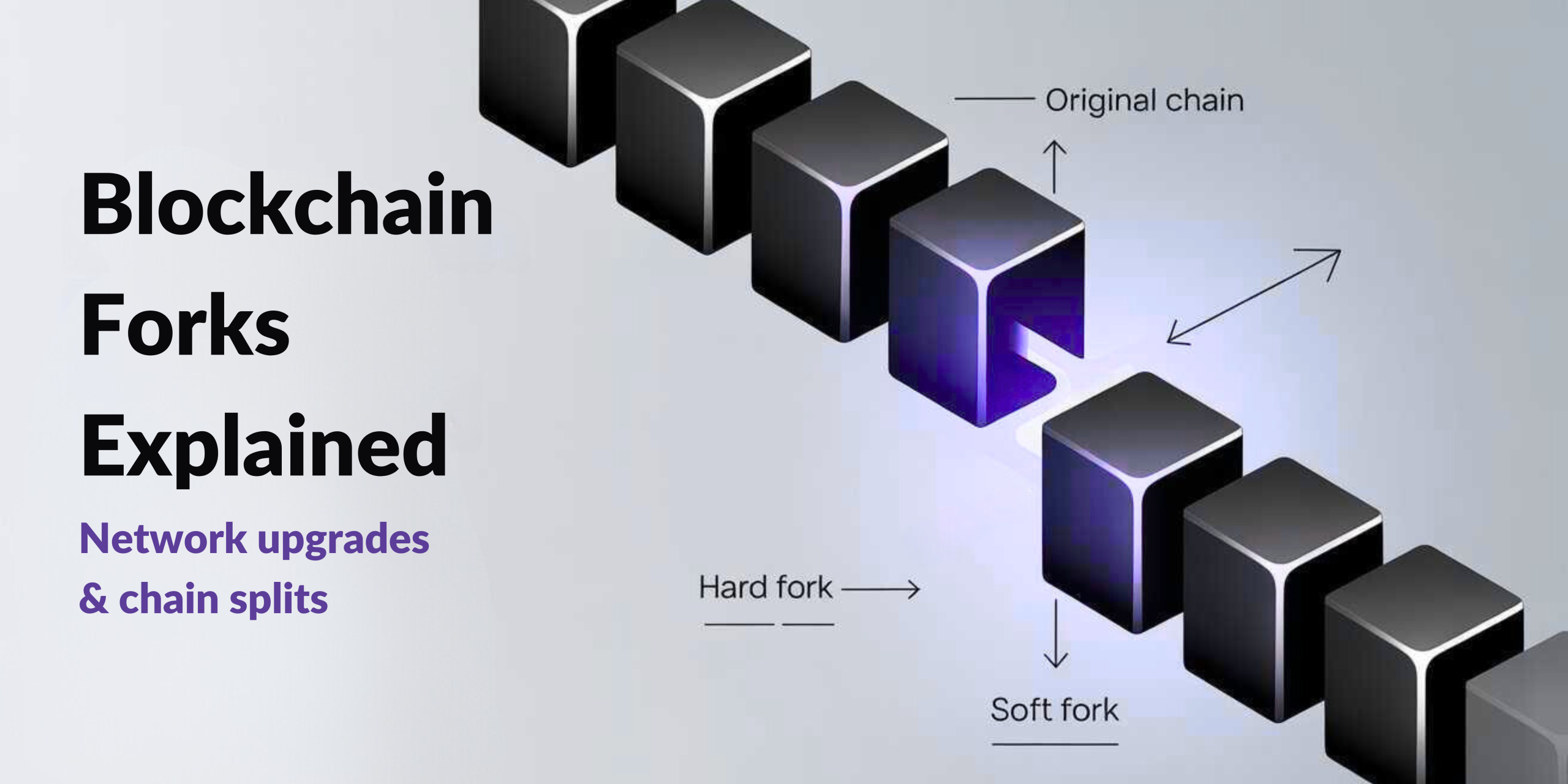

Fork Types: Hard Forks vs Soft Forks and Backward Compatibility

Blockchain networks implement two distinct types of forks, each serving different purposes in network evolution. Hard forks and soft forks differ fundamentally in their approach to backward compatibility and network consensus requirements.

Hard Forks: Breaking Backward Compatibility

Hard forks create permanent changes to blockchain protocols by breaking backward compatibility. Consequently, all network participants must upgrade their software to continue participating in the network. These forks often introduce significant protocol modifications that older software versions cannot interpret.

Think of hard forks as mandatory system-wide upgrades that fundamentally change the rules of engagement. When Bitcoin implemented SegWit2x proposals or when Ethereum moved toward proof-of-stake, these represented hard fork territories where networks needed complete consensus.

Key characteristics of hard forks include:

- Complete network upgrade requirement – All nodes must update to the new protocol

- Potential for permanent chain splits if community consensus isn’t achieved

Furthermore, hard forks can be either planned upgrades agreed upon by the community or contentious splits that divide the network into competing chains. Planned hard forks typically receive broad community support, whereas contentious forks create parallel blockchain networks.

Soft Forks: Maintaining Backward Compatibility

Soft forks implement protocol changes while maintaining backward compatibility with older software versions. Therefore, these upgrades allow networks to evolve without forcing immediate adoption across all participants. Non-upgraded nodes can continue operating, although they may have limited functionality.

Consider soft forks as optional updates that enhance network features without breaking existing functionality. The Lightning Network implementation on Bitcoin represents a perfect example of soft fork innovation that improved scalability without disrupting core operations.

Essential features of soft forks include:

- Backward compatibility preservation allowing older nodes to remain functional

- Gradual adoption processes that don’t require immediate network-wide updates

- Lower risk of chain splits due to maintained compatibility

Additionally, soft forks typically introduce more restrictive rules or optimize existing functionality. They represent a more conservative approach to blockchain evolution, prioritizing network stability over rapid innovation.

Upgrade Mechanisms: Protocol Changes and Community Consensus

Blockchain networks employ various mechanisms to implement protocol changes and achieve community consensus. These processes ensure that network modifications reflect the collective will of participants while maintaining decentralized governance principles.

Governance Models and Decision-Making

Different blockchain networks utilize distinct governance approaches for implementing forks. Bitcoin relies on rough consensus among developers, miners, and users through informal processes. Ethereum follows a similar model with Ethereum Improvement Proposals (EIPs) that undergo community review and discussion.

The beauty of blockchain governance lies in its democratic nature, where no single entity controls network evolution. However, this decentralized approach can sometimes lead to heated debates and community divisions, as witnessed during major upgrade controversies.

Meanwhile, newer networks often implement formal governance mechanisms such as:

- On-chain voting systems where token holders directly influence protocol decisions

- Multi-stakeholder consensus processes involving different network participants

Technical Implementation Process

Protocol upgrades typically follow structured implementation phases. Initially, developers propose changes through improvement proposals that undergo technical review. Subsequently, the community discusses implications, benefits, and potential risks associated with proposed modifications.

The activation process varies by network but generally includes:

- Code development and testing phases ensuring upgrade reliability

- Community review periods allowing stakeholder input and feedback

- Activation triggers that implement upgrades once consensus thresholds are met

Furthermore, most networks implement testnet deployments before mainnet activation. This approach allows developers to identify potential issues and optimize implementations before affecting live networks.

Chain Reorganization: Temporary Blockchain Forks and Longest Chain Rule

Chain reorganization represents a natural occurrence in blockchain networks where temporary forks resolve through the longest chain rule. These events demonstrate how distributed networks maintain consensus despite temporary disagreements about valid transaction history.

Understanding Temporary Forks

Temporary forks occur when multiple miners or validators simultaneously produce valid blocks. Consequently, the network temporarily splits as different nodes accept different versions of the blockchain. However, these situations typically resolve quickly as the network converges on a single valid chain.

Picture two miners solving a puzzle at nearly the same moment—both solutions are valid, but the network can only accept one. This creates a temporary disagreement that resolves naturally through built-in consensus mechanisms.

Common causes of temporary forks include:

- Network latency causing delayed block propagation across the network

- Simultaneous block mining by different participants at similar timestamps

- Network partitions temporarily isolating groups of nodes from each other

Longest Chain Rule Resolution

The longest chain rule provides the fundamental mechanism for resolving temporary forks. Networks automatically accept the chain with the most cumulative work or highest block count as the valid blockchain. This process ensures eventual consistency across distributed nodes.

Key aspects of chain reorganization include:

- Automatic resolution processes that don’t require human intervention

- Network stability maintenance through consistent consensus mechanisms

- Economic incentives that encourage mining participants to build on the longest chain

Moreover, deeper chain reorganizations become increasingly unlikely due to the exponentially increasing computational cost required to overturn established blocks. This mathematical certainty provides the security foundation for blockchain networks.

Historical Examples: Bitcoin Cash Fork and Ethereum DAO Fork Analysis

Historical blockchain forks provide valuable lessons about community governance, technical challenges, and the consequences of network splits. Two particularly significant examples demonstrate different approaches to handling contentious protocol changes.

Bitcoin Cash Fork: Scaling Debate Resolution

The Bitcoin Cash fork of 2017 resulted from fundamental disagreements about Bitcoin’s scaling approach. The Bitcoin community split between those favoring larger block sizes and those supporting off-chain scaling solutions like the Lightning Network.

This contentious hard fork created two separate networks:

- Bitcoin (BTC) maintained the original 1MB block size limit with SegWit activation

- Bitcoin Cash (BCH) increased block size to 8MB for higher transaction throughput

- Market valuation split distributed value between the two competing networks

The fork demonstrated how blockchain governance challenges can lead to permanent network splits when consensus cannot be achieved. Additionally, it highlighted the importance of clear governance mechanisms for handling protocol disagreements.

Ethereum DAO Fork: Security and Immutability

The Ethereum DAO fork of 2016 addressed a critical smart contract vulnerability that resulted in significant fund losses. The community faced a dilemma between maintaining blockchain immutability and recovering stolen funds through protocol intervention.

This controversial hard fork resulted in:

- Ethereum (ETH) implementing the fork to reverse DAO hack transactions

- Ethereum Classic (ETC) maintaining the original blockchain without intervention

- Philosophical divisions about blockchain immutability principles

Furthermore, this incident illustrated how blockchain networks can respond to critical security issues while respecting community preferences. The fork demonstrated that blockchain immutability, while important, isn’t absolute when community consensus supports intervention.

Future of Blockchain Forks and Network Evolution

Blockchain fork mechanisms continue evolving as networks mature and face new challenges. Emerging governance models increasingly incorporate formal voting systems and transparent decision-making processes. These developments aim to reduce contentious splits while maintaining decentralized principles.

Additionally, cross-chain interoperability protocols are reducing the impact of network splits by enabling asset transfers between forked chains. This evolution suggests that future blockchain forks may be less disruptive to users and developers.

The integration of artificial intelligence in blockchain governance is also emerging as a potential enhancement to fork mechanisms. AI systems could help analyze proposed changes, predict outcomes, and facilitate more informed community decision-making processes.

FAQs:

- What’s the main difference between hard forks and soft forks?

Hard forks break backward compatibility and require all participants to upgrade, while soft forks maintain compatibility with older software versions. Hard forks can create permanent chain splits if consensus isn’t achieved, whereas soft forks typically avoid this risk. - Why do blockchain networks need forks for upgrades?

Blockchain networks are decentralized systems without central authorities to implement changes unilaterally. Forks provide mechanisms for achieving community consensus on protocol modifications while maintaining the network’s decentralized nature and ensuring all participants agree on new rules. - How do temporary forks resolve automatically?

Temporary forks resolve through the longest chain rule, where the network automatically accepts the chain with the most cumulative work. Economic incentives encourage miners and validators to build on the longest chain, ensuring network convergence without manual intervention. - Can blockchain forks be prevented entirely?

While temporary forks occur naturally due to network conditions, contentious permanent forks can be minimized through better governance mechanisms, clear upgrade processes, and effective community communication. However, completely preventing all forks isn’t possible or necessarily desirable in decentralized networks. - What happens to my cryptocurrencies during a hard fork?

During a hard fork, holders typically receive equivalent amounts of cryptocurrency on both resulting chains. However, the relative value of each chain depends on market adoption, developer support, and community acceptance. Users should follow official guidance from wallet providers and exchanges during fork events.

Stay updated with our latest articles on fxis.ai