In an age where managing finances is more complex than ever, the launch of the app “Dave” is a refreshing reprieve for consumers tired of grappling with excessive bank fees. Imagine an adorable AI dressed in a bearsuit, designed to save you from the clutches of overdraft penalties. Dave aims to help users navigate their financial lives with minimal stress and optimal support. Let’s take a closer look at how this innovative app is changing the way we think about spending and saving.

The Concept Behind Dave

At its heart, Dave employs sophisticated machine learning algorithms to analyze your spending patterns using access to your checking account. The app predicts your “7 Day Low,” a forecast of the lowest your bank balance might dip within the week, helping you plan ahead for any incoming transactions. Co-founder Jason Wilk describes it as a “weather forecast” for your finances — enabling better budgeting and reducing reliance on costly overdrafts.

Empowering Users to Avoid Overdrafts

- Alerts and Notifications: Users receive timely alerts regarding pending transactions, allowing them to adjust their spending before their account goes into the red.

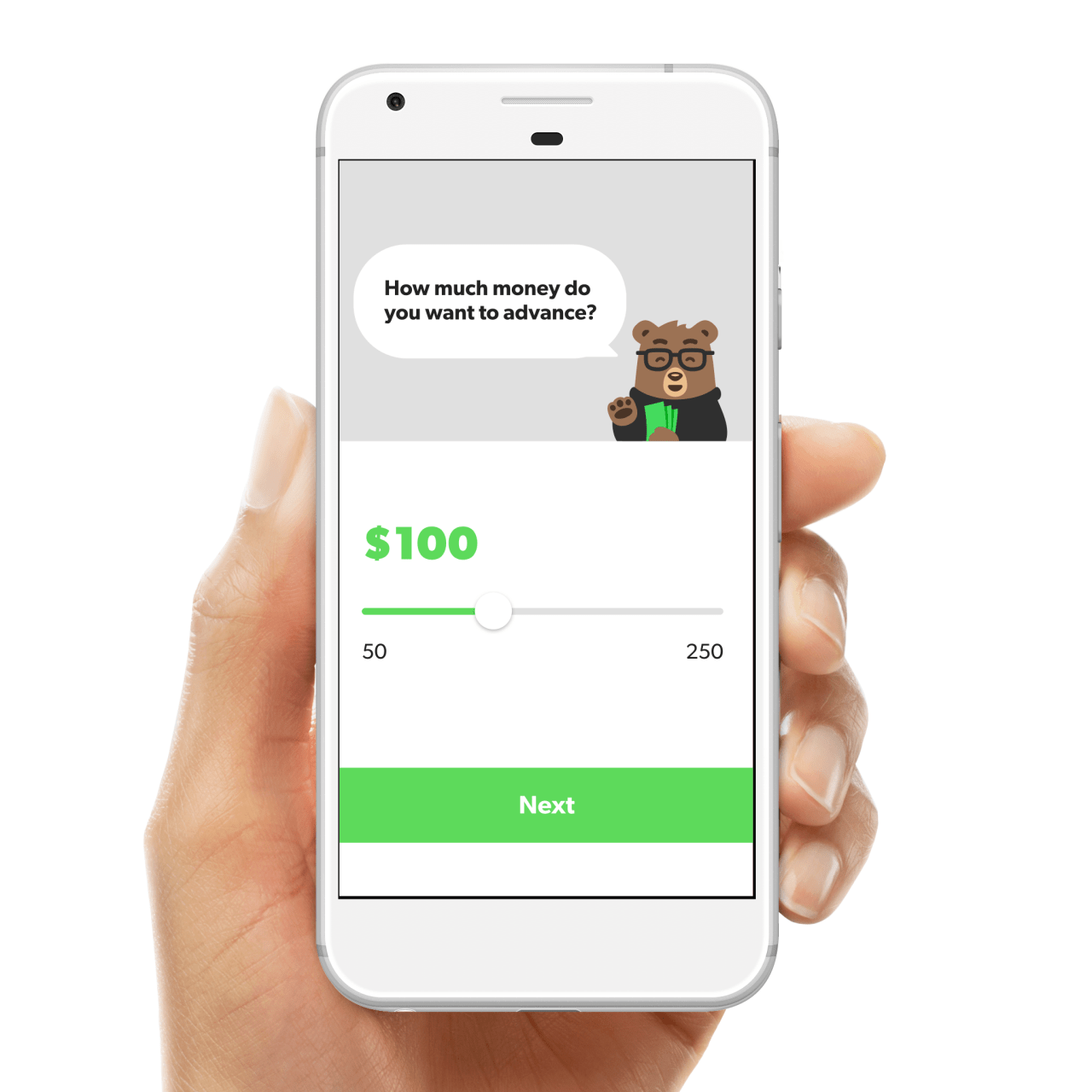

- Borrowing with Integrity: If circumstances still lead to a potential overdraft, Dave provides the option to borrow up to $250 with a 0% interest rate, paid back only when convenient for the user.

- Emotional Support: By naming the app “Dave,” the team turned it into a friendly companion, much like reaching out to a family member for financial support.

The beauty of this approach is that it not only empowers users to avoid overdraft fees but also establishes a more human, supportive relationship with their finances. Given the statistics that show overdraft fees amounting to approximately $36 billion in the U.S. annually, offering alternatives like those provided by Dave seems timely and necessary.

A Fair and Generous Approach to Financing

Unlike traditional payday lending systems that often charge exorbitant interest rates, Dave is a breath of fresh air. Users are encouraged to support the platform with voluntary tips, which can be directed towards a noble cause— Trees for the Future. For every percentage chosen to tip, the company plants a corresponding number of trees, adding an environmental benefit to the financial service.

Building Trust and Transparency

Initially, concerns about data privacy arose as the app’s policy appeared to allow sharing personal data with third parties. However, Wilk promptly addressed these issues, asserting the commitment to user privacy. The updated privacy policy guarantees that Dave will not share personal data for marketing purposes, aligning with its mission to prioritize user experience.

Meeting the Needs of a Diverse Audience

While the app is primarily aimed at Millennials, the feedback received indicates its utility across generations. Wilk notes that with one million installations being a target goal in a year, Dave’s functionality could appeal to anyone frustrated by bank fees. The emphasis on a smart solution to ubiquitous banking issues speaks volumes about its accessibility and relevance.

Conclusion: The Future of Budgeting with Dave

As consumers become increasingly disenchanted with typical financial services, Dave presents a compelling alternative, putting power back into the hands of individuals. By combining technology, community-driven support, and a commitment to financial education, Dave is more than just an app; it’s a financial movement. The vision extends beyond overdraft fees, with aspirations to tackle other prevalent banking issues, further enhancing user experience.

For more insights, updates, or to collaborate on AI development projects, stay connected with fxis.ai. At fxis.ai, we believe that such advancements are crucial for the future of AI, as they enable more comprehensive and effective solutions. Our team is continually exploring new methodologies to push the envelope in artificial intelligence, ensuring that our clients benefit from the latest technological innovations.