In the bustling world of finance, understanding the intricacies of high-frequency limit order books can be the golden key to making informed trading decisions. This blog post will walk you through how to leverage machine learning to model these dynamics effectively. The journey involves feature extraction, training various models, and making predictions with impactful PL (profit and loss) outcomes. Let’s dive in!

Overview

This project utilizes machine learning methods to delve into the fast-changing environment of high-frequency limit order book dynamics. By employing a simple trading strategy, we aim to analyze the resultant PL outcomes based on the features we extract.

Feature Extraction

At the core of our modeling lies the feature extraction process, where we capture essential market signals. Here are two primary features we’ve focused on:

- Rise Ratio

- Depth Ratio

These features help us gauge market movements effectively, offering insights into potential trading opportunities.

Learning Model Trainer

Once we have identified our features, the next step involves training a variety of machine learning models for prediction purposes. Here are the models suited for our task:

- RandomForestClassifier

- ExtraTreesClassifier

- AdaBoostClassifier

- GradientBoostingClassifier

- SVM

After training these models, we will utilize the best-performing one to predict market behavior for the next 10 seconds based on the features extracted.

Prediction Outcomes

Once the best model is identified, the prediction phase unfolds. The outcomes not only provide insights into potential market direction but also play a crucial role in formulating our trading strategies.

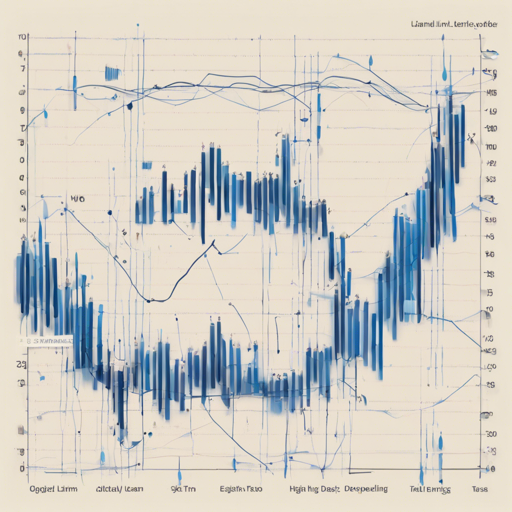

Profit & Loss Analysis

Finally, we assess the performance of our strategy through a profit and loss analysis. This crucial step helps us understand the efficacy of our model in a practical setting.

Troubleshooting

If you encounter challenges while applying this framework, consider these troubleshooting steps:

- Double-check the data quality: Ensure that the data fed into your models is clean and preprocessed properly.

- Model Selection: If the results aren’t as expected, experiment with hyperparameter tuning to improve model performance.

- Feature Importance: Analyze which features contribute most to predictions and adjust accordingly.

- Re-evaluate strategies: If PL outcomes are underwhelming, reassess your trading strategy and make necessary adjustments.

For more insights, updates, or to collaborate on AI development projects, stay connected with fxis.ai.

Conclusion

Modeling high-frequency limit order book dynamics using machine learning is a multifaceted process that can yield productive insights into the commodities market. By meticulously evaluating features and honing predictive models, we can significantly enhance trading strategies. Remember, at fxis.ai, we believe that such advancements are crucial for the future of AI, as they enable more comprehensive and effective solutions. Our team is continually exploring new methodologies to push the envelope in artificial intelligence, ensuring that our clients benefit from the latest technological innovations.