The financial landscape is evolving rapidly, with technology paving the way for innovations that help individuals manage their expenses more efficiently. Enter Trim, a personal finance chatbot that promises to transform the way we interact with our finances. This dynamic bot, which recently raised $2.2 million in funding, focuses on simplicity and user engagement, aiming to empower consumers to take control of their financial health.

Understanding Trim: A Chatbot for Your Finances

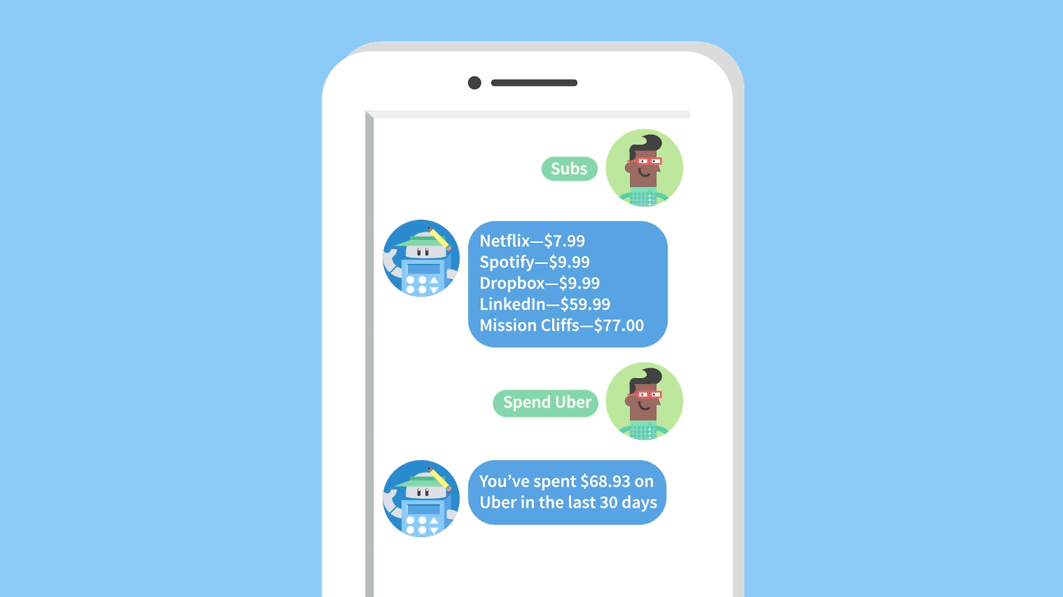

Imagine having a financial assistant at your fingertips, accessible through SMS or Facebook Messenger. Trim makes this a reality by providing a streamlined service that allows users to monitor their spending, manage subscriptions, and even set up spending alerts—all without the need for a dedicated mobile app. This approach resonates strongly with modern users, who often prefer quick interactions over traditional app interfaces.

Key Features of Trim: What You Can Do

- Monitor Spending: Trim keeps track of your monthly expenditures, including specific insights like how much you’re spending on services such as Uber.

- Subscription Management: One of Trim’s standout features is its ability to identify unwanted subscriptions and help users cancel them, sparing them unnecessary costs.

- Alerts and Notifications: Set up personalized spending alerts that notify you when you approach your budget limits or when unusual spending occurs.

- Bank Balance Checks: Users can quickly check their bank balance through simple text requests, making financial oversight seamless.

The Financial Edge: Impact on Users

Since its launch, Trim has made significant strides. The team estimates that they have saved users an impressive $6 million by identifying and eliminating redundant subscriptions. This financial tool is more than just a chatbot; it represents a shift toward consumer-centric financial management. CEO Thomas Smyth notes that Trim aims to be an alternative not only to traditional banking apps but also to other personal finance applications that require complex interactions.

Backing from Believers: Funding and Support

Trim’s expansion has attracted the attention of notable investors, including actor and entrepreneur Ashton Kutcher, who is participating through his investment firm, Sound Ventures. Eniac Ventures is leading the current financing round, with support from Version One Ventures and Core Innovation Capital. This backing signifies a strong belief in Trim’s potential to affect positive change in personal finance for families across the nation.

A Glimpse into the Future: Monetization and Innovation

Despite being a free service at present, Trim plans to explore monetization through premium features. This strategy could allow them to enhance their offerings while maintaining accessibility for users looking to improve their financial management. The chatbot ecosystem is still in its infancy, but Trim represents a promising model for future financial technologies.

Conclusion: The Future of Personal Finance

As technology continues to influence our financial decisions, tools like Trim are becoming increasingly essential. With its user-friendly interface and powerful features, this chatbot is not just about managing finances but reimagining how we engage with our money on a daily basis. At fxis.ai, we believe that such advancements are crucial for the future of AI, as they enable more comprehensive and effective solutions. Our team is continually exploring new methodologies to push the envelope in artificial intelligence, ensuring that our clients benefit from the latest technological innovations.

For more insights, updates, or to collaborate on AI development projects, stay connected with fxis.ai.