In the constantly shifting landscape of technology investments, few stories have blended drama and triumph as seamlessly as the saga of SoftBank and its prized asset, Arm Holdings. Once teetering on the brink of financial adversity with a staggering loss in their Vision Fund, SoftBank’s fortunes have been rejuvenated significantly, all thanks to the remarkable resurgence of Arm. The story of this chip design giant is not just a tale of stocks and earnings—it’s a lens into the transformative nature of the tech industry, particularly around the booming field of artificial intelligence.

A Tale of Two Paths: SoftBank’s Struggles and Arm’s Success

Just a few months ago, SoftBank stood at a crossroads, grappling with a financial downturn attributed largely to unfortunate investments, such as the much-criticized WeWork. The Vision Fund had posted a significant loss of $6.2 billion in Q2 2023, casting a shadow over the company’s future direction. However, in a stunning reversal, SoftBank was buoyed by Arm’s impressive IPO and subsequent performance.

Arm’s IPO: A Game-Changer for SoftBank

Launched to the public market in September, Arm represents not only a pivotal asset for SoftBank but also a beacon of innovation in the tech sector. Holding about 90% of Arm’s stock—around 930 million shares—SoftBank’s fortunes hinged on Arm’s performance. And boy, did Arm deliver!

- In its latest earnings report, Arm surpassed analyst expectations, reporting adjusted earnings per share of 29 cents against an anticipated 25 cents.

- The company’s revenue soared 14%, hitting $824 million compared to an expected $761 million.

- Looking ahead, Arm projects even more robust growth with potential revenue increases of 38% in the upcoming quarter.

The AI Gold Rush: Fueling Arm’s Revenue Stream

The surge in Arm’s performance is inextricably linked to the growing demand for AI technologies. Major players like Microsoft and Amazon are increasingly leveraging Arm’s chip designs to power their AI models, indicating a shift in how technology is utilized across various sectors. This growing segment of AI-driven chip sales is vital for SoftBank, especially as these products command higher royalty fees.

- Approximately 35% of Arm’s overall shipments are dedicated to mobile devices—an area that’s still thriving.

- However, as AI applications expand, Arm’s revenue from custom-designed chips for AI workloads is rapidly on the rise.

- Arm charges roughly double the royalty rate for its latest chip architecture, indicating robust margins for this segment.

SoftBank’s Strategic Choices Ahead

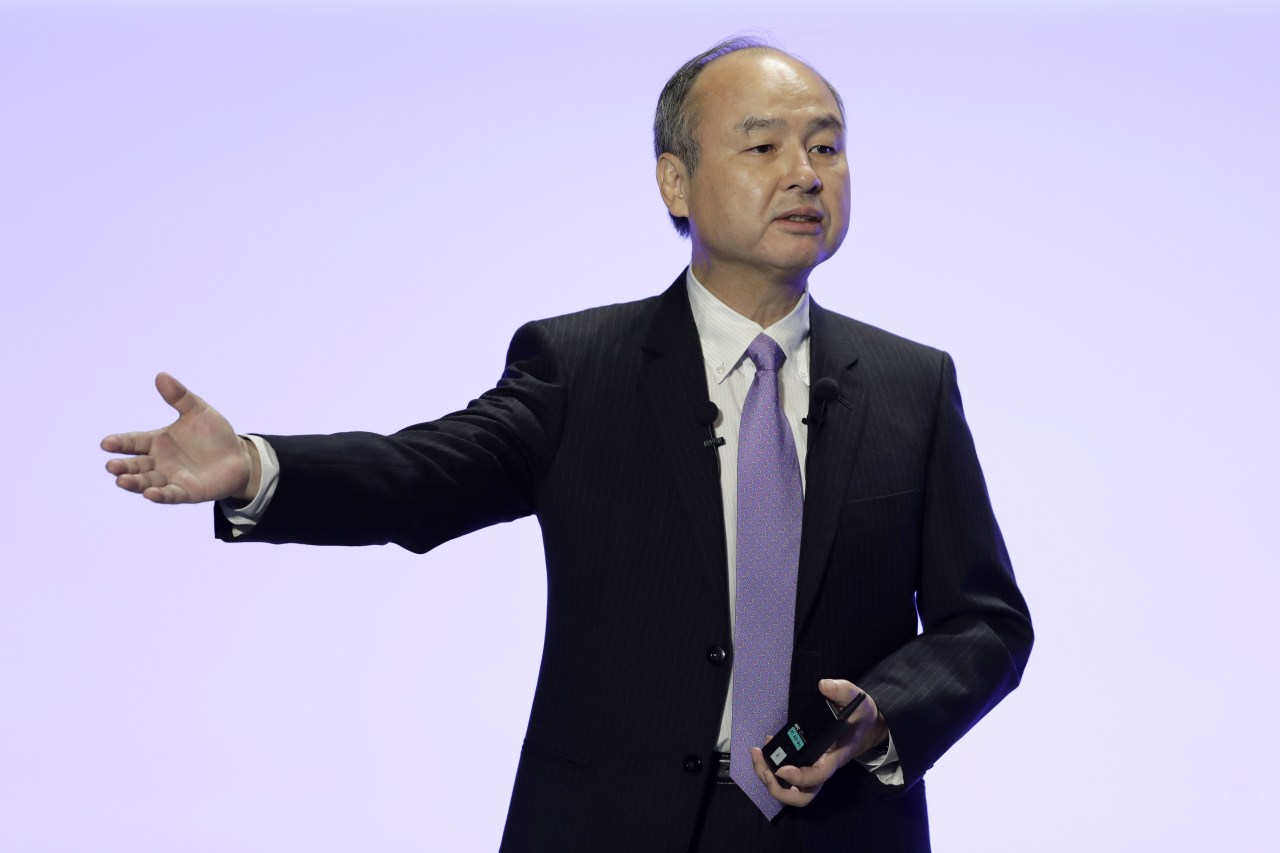

As SoftBank gears up for the next phase following Arm’s IPO, the question looms large—what path will Masayoshi Son and his team take? Currently unable to sell Arm shares until March, SoftBank may utilize this period to assess the market landscape, especially in light of the ongoing AI enthusiasm. The options are plentiful: they could opt for a stock buyback to boost share values or hold tight, betting on long-term growth.

Conclusion: A Fragile Yet Promising Future

As SoftBank rides the wave of Arm’s successful resurgence, the future appears less uncertain. However, with the ever-changing dynamics of global markets, particularly the ups and downs in U.S.-China relations, it remains to be seen whether this momentum can be sustained. With a delicate balance to maintain between immediate gains and long-term strategies, only time will tell how this narrative unfolds.

At **[fxis.ai](https://fxis.ai)**, we believe that such advancements are crucial for the future of AI, as they enable more comprehensive and effective solutions. Our team is continually exploring new methodologies to push the envelope in artificial intelligence, ensuring that our clients benefit from the latest technological innovations. For more insights, updates, or to collaborate on AI development projects, stay connected with **[fxis.ai](https://fxis.ai)**.