In an era defined by technological evolution, artificial intelligence is not just a buzzword; it is transforming industries across the board. The latest development in this evolution comes from Tractable, a pioneering startup that applies AI and computer vision to revolutionize insurance claim assessments for vehicles and property. Recently, Tractable secured $65 million in Series E funding led by the SoftBank Vision Fund 2, allowing it to extend its footprint in this burgeoning sector further. Let’s explore how Tractable is leveraging advanced technologies to reshape the world of insurance and enhance customer experiences.

Revolutionizing Claims Processing with AI

Tractable’s breakthrough technology allows insurers to streamline the claims assessment process, handling an impressive $7 billion in claims annually. They’ve partnered with well-known names such as Aviva, Geico, and Admiral, making waves in the market. The recent infusion of funds is not only aimed at scaling their current operations but also expanding into critical markets like Japan.

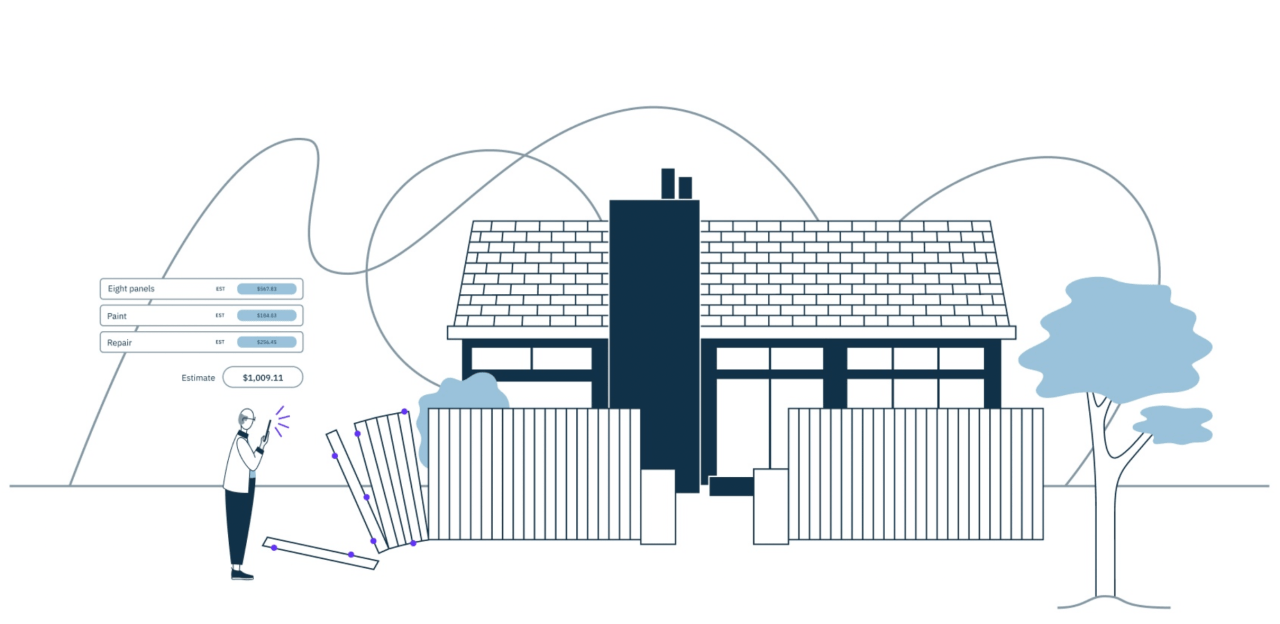

- Innovative Use of Computer Vision: Tractable’s computer vision algorithms perform remote damage assessments, offering faster and more reliable service to clients. This not only reduces the time taken for claim settlements but also enhances customer trust.

- Expansion Beyond Assessments: With the new funding, Tractable intends to delve deeper into beyond just appraisals, exploring avenues in repairs, maintenance, and sales linked to assessed items. This multi-faceted approach opens up new revenue streams.

- Strategic Growth in Japan: With significant volume growth expected within Tractable’s operational metrics in Japan, the startup is gearing up to cater to this lucrative market actively. Japan’s digital-savvy population presents an exciting opportunity for scalable AI solutions.

The Role of Generative AI and LLMs

Tractable’s CEO, Alex Dalyac, discusses the exciting advancements in generative visual AI and Large Language Models (LLMs). Such technologies not only refine the appraisal process but pave the way for an interactive AI that can guide users regarding their automotive or property repairs.

Imagine an AI system that not only evaluates damage but also engages customers in conversation, answering their queries and offering tailored solutions based on their unique situations. This possibility is becoming increasingly realistic as advancements in AI are made.

Competitive Landscape: Rise of Alternatives

While Tractable leads the charge, the competitive landscape is becoming increasingly crowded with alternatives such as Uveye and ProovStation. Each company is vying to provide more effective assessment tools, emphasizing the importance of Tractable diversifying its offerings. The current market saturation highlights the necessity for pioneering companies to innovate continually.

Beyond Profitability: Navigating Economic Challenges

As Tractable continues its mission, it also faces the hard truth of the contemporary economic environment. With a focus on long-term growth over profits, the company acknowledges the necessity to recalibrate in a post-pandemic world where profitability is not a nuisance but rather a key strategic goal. Their strong SaaS margins bolster hope for achieving EBITDA breakeven soon.

Looking Forward: Opportunities and Challenges

As Tractable moves ahead, the potential for strategic collaboration with SoftBank positions the company uniquely within the vast enterprise ecosystem of Japan. The country’s stature as a major automotive manufacturing hub complements Tractables ambitions of integrating their technology more deeply into vehicle lifecycle management. From proactive maintenance and damage assessments to recycling initiatives, the possibilities are expansive.

With a significant injection of capital and a robust technological backbone, Tractable stands at the forefront of transforming not just insurance claims but how we interact with our most valuable assets. This evolution is not merely about efficiency; it is a reimagining of the insurance landscape forged by ingenuity and cutting-edge AI technology.

Conclusion

The integration of AI in assessing and managing insurance claims represents a dramatic shift in traditional business operations. Tractable’s most recent funding, expert insights into AI capabilities, and commitment to growth place it at a pivotal junction in the industry. The convergence of technology, finance, and strategic partnerships signals an exciting era for Tractable and its clients.

At fxis.ai, we believe that such advancements are crucial for the future of AI, as they enable more comprehensive and effective solutions. Our team is continually exploring new methodologies to push the envelope in artificial intelligence, ensuring that our clients benefit from the latest technological innovations.

For more insights, updates, or to collaborate on AI development projects, stay connected with fxis.ai.