Tax season is often viewed as a dreaded yearly obligation, bringing with it a mix of confusion, frustration, and mounting paperwork for millions of individuals and businesses. For those with more complex financial situations, seeking help from tax professionals isn’t just advantageous; it’s often necessary. However, even these seasoned experts can find the intricate landscape of tax codes overwhelming. Enter IBM Watson and HR Block’s innovative partnership, designed to simplify the tax preparation process using the power of artificial intelligence.

The Challenges of Tax Preparation

The traditional tax preparation process can often feel daunting. Long hours spent sifting through documents and feeling like you’re navigating a maze of regulations can lead to stress and potentially costly mistakes. The New York Times reports that the IRS tax code stretches over 74,000 pages, making it nearly impossible for any human to keep it all in mind. This is where machine intelligence like IBM Watson steps in to change the game.

Setting the Stage for AI Assistance

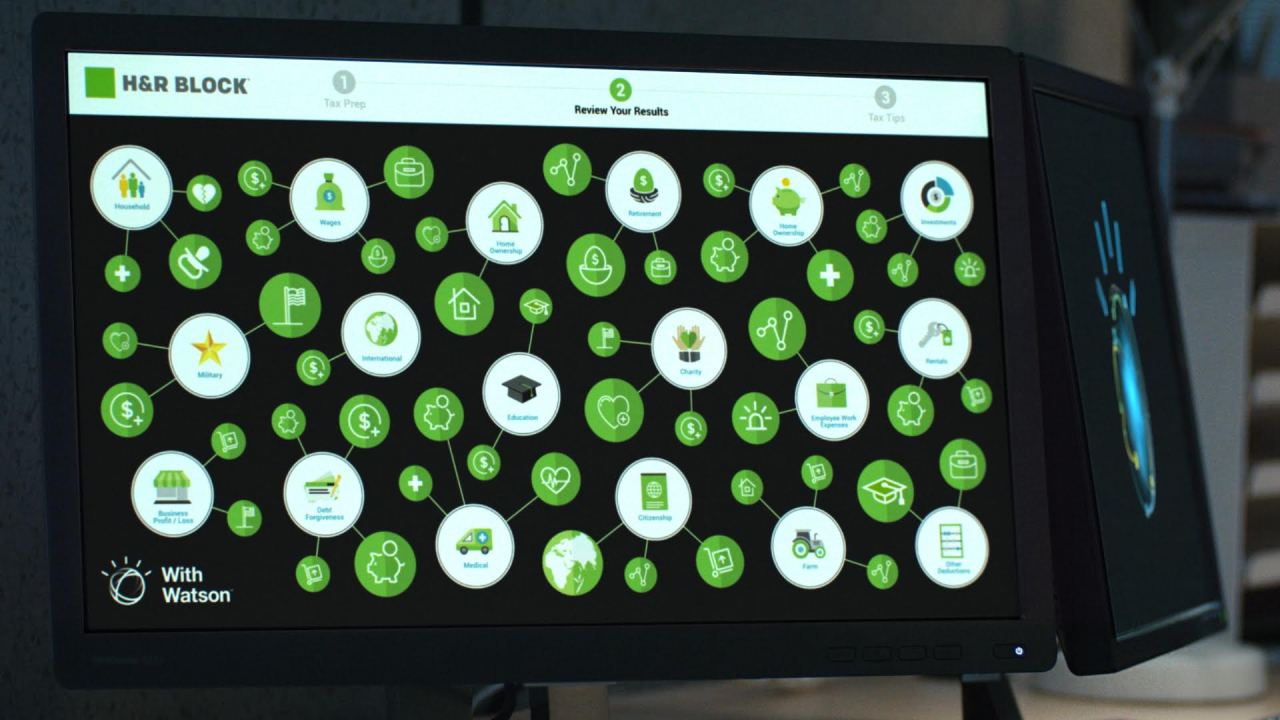

HR Block has chosen to partner with IBM to tackle a critical aspect of tax preparation: identifying deductions and credits. With the goal of maximizing refunds and minimizing tax liabilities, the consumer-facing application of AI addresses the most pressing concern for clients. By utilizing IBM’s natural language processing capabilities, Watson can effectively analyze tax documents and provide insights that are grounded in the extensive federal tax code.

How Watson Works

- Natural Language Processing: Watson parses tax-related phrases and sentences, translating complex legal jargon into understandable language for both HR Block employees and clients.

- Continuous Learning: As Watson engages with new tax documents every year, it refines its algorithms, continually improving its ability to find potential deductions.

- Consumer Engagement: Customers can interact directly with Watson during their appointments at HR Block locations, providing a seamless and informative experience.

The Future of Tax Preparation

This partnership is not just an isolated innovation; it signifies a broader trend in how industries are beginning to leverage AI technologies. Watson’s implementation in the tax realm is likely to pave the way for further enhancements in various financial services. As AI evolves, it can facilitate automated processes that promise to increase efficiency, accuracy, and ultimately, customer satisfaction.

Public Awareness and Strategic Marketing

In a bold move to raise awareness around its collaboration with IBM, HR Block has chosen to invest in a Super Bowl advertisement — its first in eight years. This marketing strategy showcases how seriously they are committed to integrating AI into their services. By placing Watson at the forefront, HR Block aims to assure clients that the future of tax preparation will be more manageable and less intimidating.

Conclusion

The partnership of HR Block with IBM Watson represents a significant shift in how we perceive tax preparation. By harnessing the capabilities of artificial intelligence, HR Block is not only simplifying a traditionally cumbersome process but also delivering enhanced results for its customers. Every tax season thereafter promises to be less about anxiety and more about understanding, thanks to proactive technology integrations like Watson.

At fxis.ai, we believe that such advancements are crucial for the future of AI, as they enable more comprehensive and effective solutions. Our team is continually exploring new methodologies to push the envelope in artificial intelligence, ensuring that our clients benefit from the latest technological innovations.

For more insights, updates, or to collaborate on AI development projects, stay connected with fxis.ai.