As the geopolitical landscape continues to shift, the race for technological dominance, particularly in artificial intelligence (AI), has taken center stage. Recently, emerging reports suggest that the U.S. government is contemplating additional restrictions on the export of advanced AI chips to China. This proposed ban could have far-reaching repercussions for China’s burgeoning tech industry, especially as it pertains to the military and commercial sectors. In this blog, we’ll explore the implications of this potential embargo, its effects on Chinese firms, and the broader context in which this technological tug-of-war is unfolding.

The Calculating Chess Game of Chip Exports

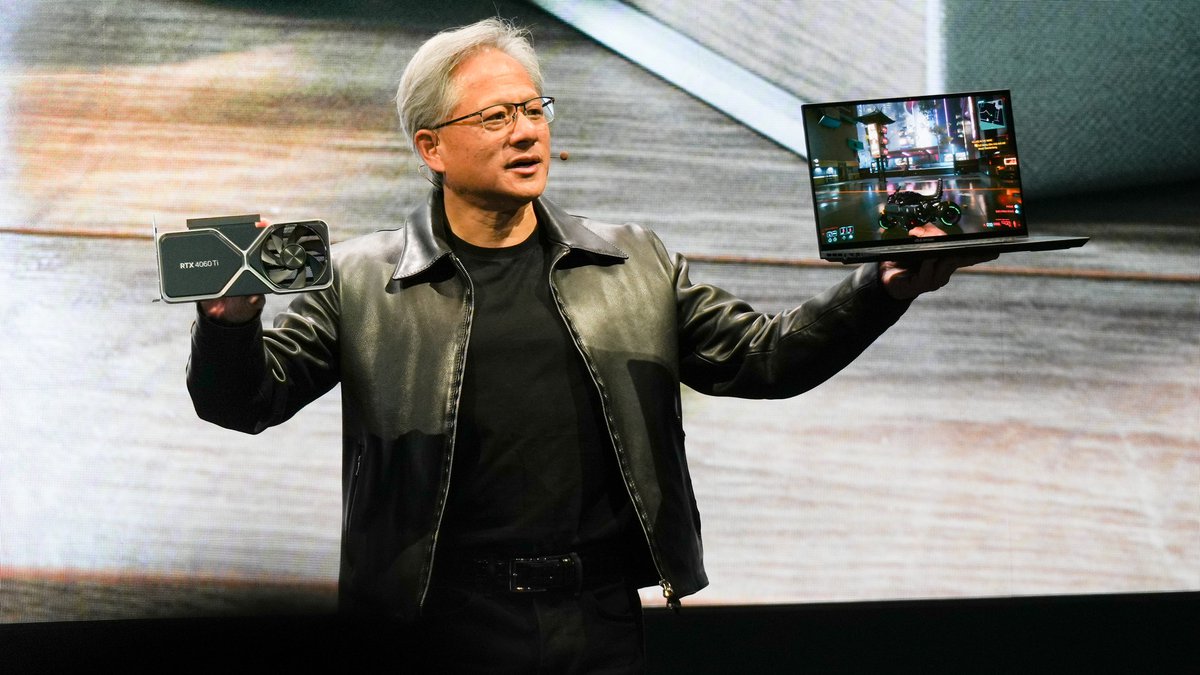

The U.S. is tightening its grip on semiconductor exports, particularly high-performance chips associated with AI advancements. Current restrictions, originally enacted in September, targeted Nvidia’s highly sought-after A100 and H100 processors. Given that these chips are crucial for training sophisticated AI models, any further escalations could stifle China’s ambitions in AI.

Mitigating the Impact with Lower-Grade Chips

In light of these challenges, companies like Nvidia have attempted to navigate these waters by developing less powerful alternatives, such as the A800. However, reports indicate that even these options may soon face regulatory scrutiny. Consequently, firms may find it increasingly difficult to access the technology needed to empower their AI initiatives. This is not merely a technical issue but a strategic challenge that affects global AI innovation.

The Dual-Edged Nature of Restrictive Measures

On the surface, the intention behind these export controls is clear: to limit China’s military capabilities. However, the reality is that such restrictive measures could inadvertently stifle the commercial AI sector in China. Many firms maintain teams across both the U.S. and China, and a lack of crucial hardware could impede their global competitiveness.

- Stockpiling Strategies: Chinese tech giants like ByteDance have already begun stockpiling Nvidia GPUs to mitigate the anticipated effects of these restrictions. With orders surpassing $1 billion, it’s evident that companies are preparing for an uncertain future.

- Bidding Wars: There’s a burgeoning black market for chips like the banned A100, where prices can skyrocket up to $20,000. This indicates both the high demand and the lengths to which firms will go to ensure they remain technologically relevant.

The Cloud Conundrum

Another layer of complexity arises from the potential restriction on the leasing of cloud services to Chinese AI firms. Many Chinese companies have gravitated towards U.S.-based cloud providers for their scalability and innovation. A ban could push these companies back to less established local options, hindering their ability to comply with data storage regulations and stiffening competition.

In this ongoing battle for technological supremacy, the broad definitions surrounding “AI companies” mean that collateral damage could extend beyond the intended targets, negatively affecting a variety of tech enterprises across China.

Conclusion: Navigating Uncharted Waters

The proposed restrictions on advanced semiconductor exports to China underscore the precarious balancing act between national security and innovation. As the situation develops, both American and Chinese companies must adapt to a rapidly evolving landscape defined by shifting trade policies and competitive influences.

At fxis.ai, we believe that such advancements are crucial for the future of AI, as they enable more comprehensive and effective solutions. Our team is continually exploring new methodologies to push the envelope in artificial intelligence, ensuring that our clients benefit from the latest technological innovations. For more insights, updates, or to collaborate on AI development projects, stay connected with fxis.ai.