The AI landscape is rapidly evolving, and as one of China’s foremost artificial intelligence solution providers, SenseTime has been on the forefront of technological advancement. However, recent geopolitical tensions have thrown a wrench in its plans to go public. With an initial public offering (IPO) valued at $767 million suddenly postponed, let’s explore the ramifications of this decision, the background leading to it, and the broader implications for the AI industry.

The Context behind SenseTime’s IPO Postponement

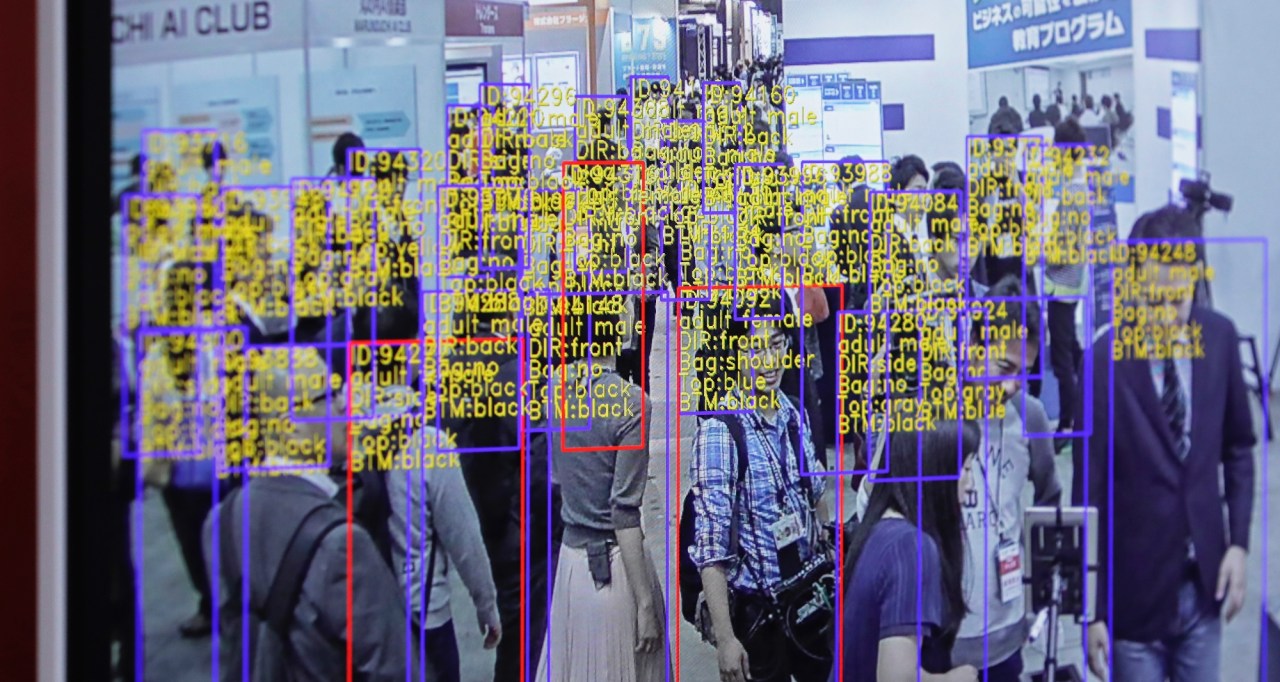

On December 10, 2021, the U.S. Department of Treasury added SenseTime to a blacklist of companies deemed part of the “Chinese military-industrial complex.” This classification came on the heels of allegations regarding the company’s facial recognition technologies, notably its ability to identify ethnic Uyghurs—raising significant ethical concerns. The blacklisting directly prohibits U.S. investors from participating in the IPO, significantly impacting investor sentiment.

In light of these developments, SenseTime announced its decision to postpone the IPO. The company stated that it would publish a supplementary prospectus with a revised timeline aimed at “safeguarding the interests” of prospective investors. This move underscores the delicate balancing act between business ambitions and geopolitical challenges.

The Economic Ramifications

For SenseTime, postponing their IPO represents not just a loss of immediate capital influx, but also poses long-term strategic risks.

- Investor Confidence: The uncertainty surrounding the IPO could dampen investor enthusiasm. By associating with geopolitical conflicts, SenseTime risks alienating potential backers in a market that is increasingly sensitive to ethical concerns.

- Market Position: As a pioneer in the AI sector, the delay could hinder SenseTime’s competitive edge. Other AI companies may seize this opportunity to strengthen their positions while SenseTime regroups.

- Global Perception: The blacklisting not only impacts U.S. investment but could also influence perceptions elsewhere. As global tensions rise, companies associated with geopolitical controversies face heightened scrutiny.

Legal and Regulatory Concerns

The ongoing scrutiny from the U.S. government poses significant legal challenges for SenseTime. The company already faced restrictions from the U.S. Entity List in 2019, and recent developments only complicate its operating environment further.

- Operational Limitations: Future collaborations with American firms may remain elusive, curbing technological synergies that could drive innovation.

- Compliance Costs: As regulations tighten, the operational overhead for compliance increases—potentially impacting future profitability.

- International Relations: As companies navigate these complex waters, the future of U.S.-China relations will be critical. A climate of distrust can lead to stricter regulations on both sides.

The Broader AI Landscape

What does SenseTime’s predicament mean for the broader AI industry? As geopolitical tensions influence tech firms, investors are likely to become increasingly discerning about where they place their bets.

- Focus on Ethics: Companies in AI may need to emphasize ethical practices and transparency to avoid fallout similar to that experienced by SenseTime.

- Innovation vs. Regulation: The tension between fostering innovation and adhering to regulations will challenge not just AI developers but also the regulatory bodies trying to keep pace with rapid advancements.

- Market Dynamics: As competitive pressures shift, we may see a reshuffling of market leaders. Agile companies that can navigate these challenges may emerge stronger.

Conclusion

The IPO postponement of SenseTime illustrates a critical juncture for both the company and the global AI industry. Geopolitical tensions can reverberate through market dynamics, influencing strategic decisions, investment patterns, and ethical considerations. While SenseTime aims to rebuild investor confidence, the broader implications serve as a cautionary tale for other AI entities traversing the complex landscape of technological innovation in a divided world.

At fxis.ai, we believe that such advancements are crucial for the future of AI, as they enable more comprehensive and effective solutions. Our team is continually exploring new methodologies to push the envelope in artificial intelligence, ensuring that our clients benefit from the latest technological innovations.

For more insights, updates, or to collaborate on AI development projects, stay connected with fxis.ai.